Operating as a fuel retailer can be one of the most difficult business ventures one can embark on. Unstable commodity prices, transportation difficulties, a lack of a consistent workforce, and ever-changing regulations are just a few of the hurdles retailers need to clear every day.

The price at the pump has been steadily rising throughout the first half of 2024, and everyone is feeling it.

But what about those rising card fees you notice on your monthly statement? Are these rising prices costing you more and eating into your bottom line?

As the price at the pump rises, the overall fees you are paying are higher than you are probably accustomed to seeing on that monthly statement. However, your fees as a percentage of your sales should trend lower as these prices increase. One of the most important metrics a retailer can focus on is their Effective Rate (gross fees/gross sales), and one of the best ways to lower that Effective Rate is by increasing the average ticket price. This can be accomplished by implementing several business tactics, such as running promotions on high-margin items, strategically placing “impulse items,” and constantly changing the store merchandise layout.

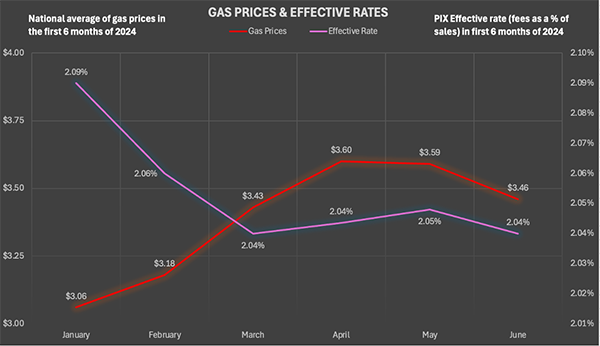

Now, back to the silver lining mentioned earlier. As the average price at the pump increases, the effective rate decreases. Let’s look at an example of the national average gas price for the first half of 2024 and how it correlates with the average Effective Rate experienced by PIX customers.

Over the last 6 months our customer base has seen a 5-basis point drop in fees. As you fight for profit with higher prices, your card processing fees can aid in winning back margin.

While that is an average, you can win back even more margin in many cases. For instance, the most common card presented at a convenience store is a debit card. The regulated debit card has an interchange fee of 0.05% + $0.22. In simple transaction terms, as the average car fill-up has gone from $40 to $70, merchants have only seen an increase of $0.02 in debit fees.

Interested in finding more wins in a world of inflation? Let’s discuss how your card fees have impacted your profit margins.