As the Federal Reserve Bank raised U.S. short term interest rates in rapid succession from near zero levels at the beginning of 2022 to over 5%, there was widespread belief that a recession would soon follow. Instead, consumer spending remained strong and labor markets tight. Now, more than two years later, a recession has yet to emerge. What happened?

Consumer Spending

In a recent Economic Letter from the Research Department of the Federal Reserve Bank of San Francisco (August 12, 2024, issue 2024-21), economists there suggest that the resilient level of consumer spending over the past two years in the face of higher interest rates can be partially explained by the large amount of wealth that households built up following the onset of the pandemic recession. The combination of large amounts of pandemic government stimulus, coupled with large sectors of the economy closed to spending, lead to a large buildup of liquid wealth. Liquid wealth includes cash, checking and savings deposits, and money market funds. These asset classes make up about 10% of overall wealth for U.S. households with the top 20% of households in the U.S. holding half of all liquid wealth.

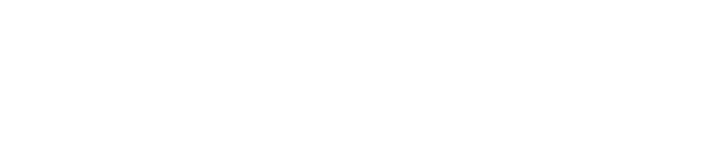

Economists at the Federal Reserve have estimated what the level of real household liquid wealth would have been over the past four years without the pandemic and then compared that to the actual level. The path is illustrated in the accompanying figure with the solid line representing the actual path and the dashed line representing the projected path. What these data show is that households in all income groups accumulated and subsequently spent these large amounts of extra liquid wealth. By early 2021 the top 20% of households had 11% more liquid assets, equaling $1.1 trillion more than would have been implied by the pre-pandemic projection; while holdings of middle- and lower-income households peaked at an additional 6%, or $270 billion, of liquid holdings.

Figure 1: Real household liquid wealth vs. non-pandemic estimates

How much of this additional liquid wealth is yet to be spent? Answer: None. Higher income households held their pandemic-era liquid wealth until mid-2022 while middle- and lower-income households spent down their pandemic-era liquid wealth by late 2021. The data suggests that it has been hard for households to downshift their spending now that their pandemic era wealth has been spent. Estimates are that higher income households now have 2% less liquid wealth and that the bottom 80% of households now have 13% less liquid wealth than if the pandemic had not occurred. This drawdown in liquid assets has coincided with an increase in household debt, which has been steadily increasing over the past few years—and recently reached all-time highs according to the Household Debt and Credit Report by the Federal Reserve Bank of New York (2024).

Household Debt

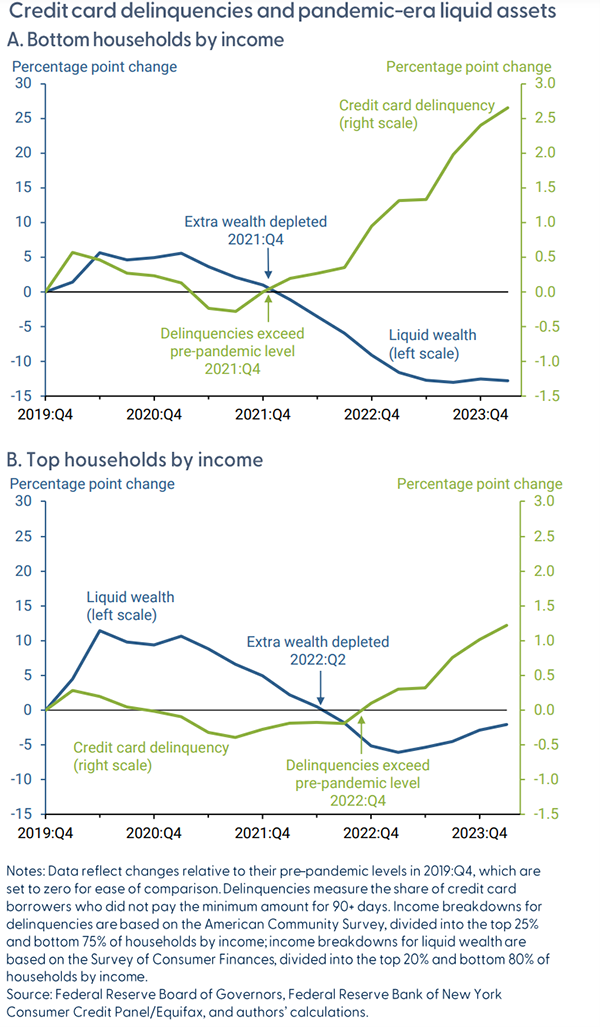

With the increasing level of household debt has come an increase in credit card delinquency rates. The table below shows that as the extra household wealth was depleted credit card debt in serious delinquency has increased. These delinquencies are now more than 2.5% higher than pre-pandemic levels for bottom households and 1.25% higher for top households. All of this suggests that U.S. households now have a significantly smaller financial cushion to weather a financial downturn or to continue spending at the rates that they have been.

Table 1: Credit card delinquencies and pandemic-era liquid assets

Recession still to come?

Is the recession still coming? Yes, while the timing is uncertain, a recession is coming and when it does, spending by the household sector will not be what props the economy up.