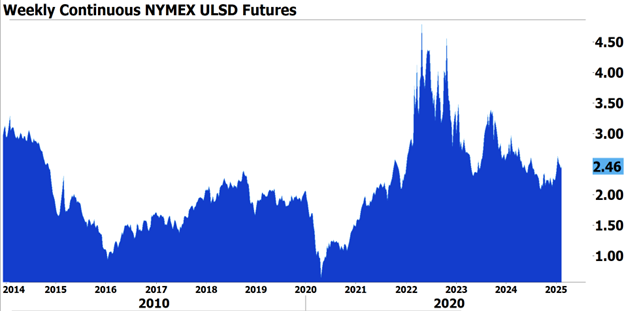

Source: LSEG

To paraphrase a saying from the software industry, volatility in the energy market isn’t a ‘bug’…it’s a feature. The chart above of the continuous NYMEX ULSD futures contract proves the point.

If you ship fuel on a pipeline or hold inventory in a storage tank, your bottom line is exposed to the possibility of loss from price fluctuations. Many fuel marketers deal with this risk by hedging. The goal of hedging is to defend your profit margin against energy price volatility and allow you to concentrate on growing your business.

Every company that hedges has asked the question, “How do I start?” Most companies start by drafting a hedging policy statement. A hedging policy serves two critical purposes:

- Helps ensure that top management and the company’s board of directors are aware of the hedging activities used by the business’s risk managers.

- Establishes the risk management framework and defines procedures and controls for the effective management of the company’s hedging activities.

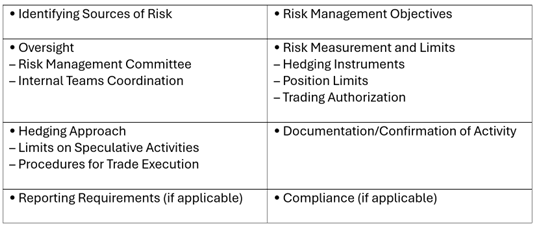

Every business is different but as you begin formulating a hedging policy for your company, it is helpful to have a robust discussion around the subjects below.

POWERHOUSE works with clients to help protect profit margins and grow their businesses by designing and implementing hedging strategies – including hedging policy statements.

We provide a suite of additional services including practical hedging training, support for marketing, and software which coordinates physical products and financial hedges.

Disclaimer

This material has been prepared by a sales or trading employee or agent of Powerhouse Brokers LLC and is, or is in the nature of, a solicitation. This material is not a research report prepared by Powerhouse Brokers LLC. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Powerhouse Brokers LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.