Why is the government asking who owns my business?

The Corporate Transparency Act (“CTA”), which is bipartisan legislation, became effective in 2024. Designed to fight money laundering and illicit finance, the CTA requires certain companies to report their beneficial ownership information (“BOI”) to the Financial Crimes Enforcement Network (“FinCEN”)—or face penalties. Originally, the CTA applied to companies organized under the laws of US states and to companies organized under the laws of foreign countries. But the law’s reach has recently been scaled back by courts and regulators, leaving many businesses in limbo. Should you file? Are you exempt? Could it change again?

What is the Corporate Transparency Act, and why does it matter?

Enacted in 2021 and effective January 1, 2024, the CTA is a federal law that requires many corporations, LLCs, and similar legal entities to report detailed information about their beneficial owners—those who own or control the company. The law aims to stop bad actors from using anonymous shell companies for illicit activities like:

- Money laundering

- Terrorist financing

- Tax evasion

- Human trafficking

The CTA represents the first nationwide effort to create a non-public, central database of business owners—accessible only to law enforcement and financial regulators.

Who must report (and who doesn’t need to)?

Originally, the law applied to nearly all U.S. corporations, LLCs, and similar entities, unless exempt.

Applicable entities included:

- Small businesses

- Single-member LLCs

- Holding companies with no employees

- Real estate investment entities

- Startups

Exemptions

There are 23 categories of exemptions, mostly for already-regulated entities such as:

- Publicly traded companies

- Banks and credit unions

- Insurance companies

- Large operating companies (20+ Full-time equivalent employees and $5M+ in revenue reported on the prior year’s tax return)

- Entities that are tax-exempt under IRS Code 501(c)

Entities not meeting one of these 23 exemptions were required to report—unless, of course, a court said otherwise. More on that below.

What’s required in a BOI report?

Companies must provide FinCEN with:

1. Identifying information about the company (legal name, address, formation details)

2. Information about each beneficial owner, including:

- Full legal name

- Date of birth

- Residential address

- A unique ID number from an acceptable document (e.g., driver’s license or passport)

3. Information about company applicants (those who filed or directed the formation documents)

This data must be submitted electronically via the FinCEN BOI e-filing system.

What are the deadlines?

Unless modified by subsequent regulations, the key deadlines are:

- Companies formed before January 1, 2024: Must file by January 1, 2025.

- Companies formed during 2024: 90 days from formation.

- Companies formed in 2025 or later: 30 days from formation.

- Foreign companies registered in the U.S.: 30 days from registration.

In March 2025, FinCEN issued a 30-day deadline extension for some companies and narrowed BOI filing requirements to apply only to foreign reporting companies—for now.

Wait… didn’t FinCEN say U.S. companies don’t have to file?

Yes, but it’s not that simple.

In March 2025, FinCEN issued an interim final rule (IFR) that exempted domestic reporting companies (i.e., U.S. entities) from CTA reporting. Only foreign entities registered to do business in the U.S. were required to file.

Sounds like good news for U.S. companies, right?

Here’s the catch: FinCEN’s rule conflicts with the CTA statute itself, which still explicitly requires domestic companies to report. That conflict has sparked confusion—and litigation.

The litigation wars: courts enter the chat

Several courts have weighed in on the CTA’s constitutionality and issued inconsistent rulings.

1. National Small Business United v. Yellen (N.D. Ala., 2024)

The Federal Court in the Northern District of Alabama declared the CTA unconstitutional as applied to members of the National Small Business Association. The court found Congress had overreached its authority under the Commerce Clause, and that the law violated small businesses’ rights under the First, Fourth, and Fifth Amendments.

2. Smith v. U.S. Department of the Treasury (E.D. Tex., 2025)

The Federal Court in the Eastern District of Texas enjoined the CTA, ruling that the law was an impermissible intrusion into intrastate business activities.

3. Texas Top Cop Shop, Inc. v. Garland (E.D. Tex., 2024)

That same court granted Plaintiffs a nationwide preliminary injunction, signaling the law’s broader vulnerability.

On the other hand…

Some cases (e.g., Community Associations Institute v. Yellen) have disagreed with these holdings, creating a patchwork of interpretations.

1. Community Associations Institute v. Yellen (E.D. Va., 2024)

The Federal Court in the Eastern District of Virginia denied the plaintiffs’ motion for a preliminary injunction against the enforcement of the CTA. The court found that the plaintiffs were unlikely to succeed on the merits of their claims and that the public interest favored the enforcement of the CTA. The court emphasized that the CTA’s reporting requirements were necessary to improve transparency and combat financial crimes.

2. Firestone v. Yellen (D. Or., 2024)

The Federal Court in Oregon denied the plaintiffs’ motion for a preliminary injunction, ruling that they failed to demonstrate a likelihood of success on the merits or irreparable harm. The court found that the CTA was within Congress’s authority under the Commerce Clause and that the law did not violate the plaintiffs’ constitutional rights under the First, Fourth, Fifth, Eighth, Ninth, or Tenth Amendments.

3. Boyle v. Bessent (D. Me., 2025)

The Federal Court in Maine upheld the CTA, ruling that it was a valid exercise of the congressional power under the Commerce Clause. The court found that the CTA’s requirements were rationally related to the government’s interest in combating financial crimes, including money laundering and terrorism financing.

Bottom line: The law is actively in flux. Appeals are pending. Courts are requesting additional information from the parties in the various lawsuits. Agencies and companies are stuck between a statute, agency guidance, and conflicting court orders.

Practical Takeaways for Business Owners, In-House Counsel, and Advisors

1. Don’t assume you’re off the hook.

Even though FinCEN has temporarily exempted U.S. entities, the CTA still technically applies and trumps FinCEN’s IFR. If the courts reject the IFR, penalties could follow for non-filers. However, as with prior FinCEN guidance, we would expect some time to allow for compliance before penalties begin.

Recommendation: If you’ve already collected BOI, consider filing anyway—especially if you want to avoid continuously monitoring the situation or scrambling later.

2. Review your exemption status.

Do you qualify as a large operating company? A nonprofit? A subsidiary of an exempt entity? It’s worth revisiting your structure to confirm.

3. Keep an eye on rule changes

FinCEN has hinted that it may revise the rule further to reduce the burden on low-risk companies. That could change who must report and what’s required.

4. Prepare for state-level spillover

Even if the federal mandate weakens, some states are considering their own BOI regimes—for example, New York. A trend toward transparency is here to stay.

Penalties for noncompliance

Under the CTA, companies that willfully fail to report or provide false information face:

- Civil penalties: Up to $500/day

- Criminal penalties: Up to $10,000 in fines and/or 2 years in prison

Again, penalties are on hold for now under the IFR—but that could change.

So, should I file now or wait?

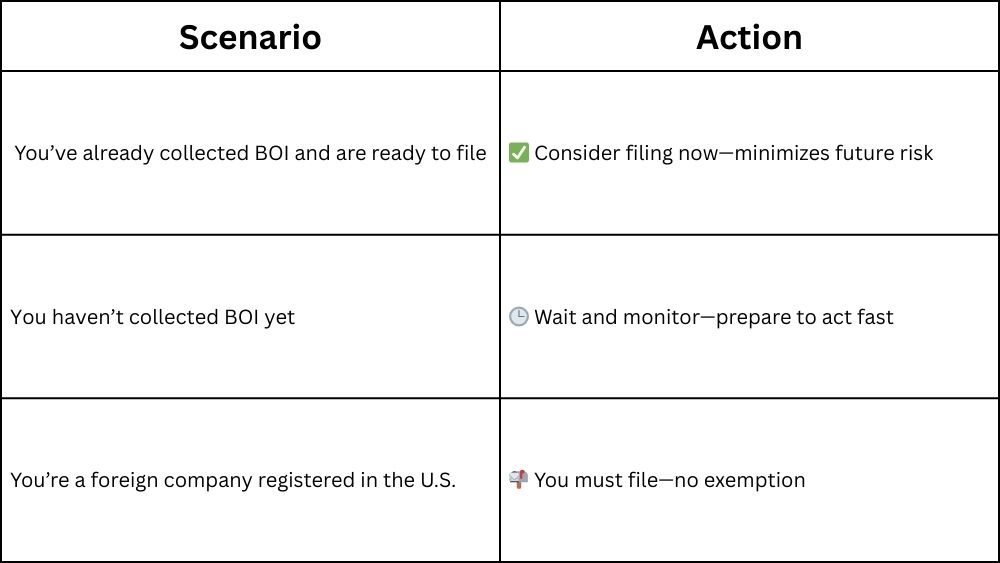

Here’s a quick decision framework:

Final Word

The CTA reflects a major shift in how the federal government views entity transparency. And while recent court rulings and regulatory about-faces have created confusion, one thing is clear: companies must stay alert, flexible, and well-advised.

Whether you’re a solo LLC owner or general counsel for a multi-entity enterprise, now is the time to:

- Reassess your entity structures.

- Understand your compliance obligations.

- Plan for different legal outcomes.

In today’s regulatory landscape, even small companies can’t afford to stay in the dark. If you’d like to learn more about the CTA, visit us at winthrop.com.

Submitted By:

Jacob S. Woodard, Counsel

Contact: 612.604.6775, jwoodard@winthrop.com

——————————————————————-

Jacob D. Flom, Paralegal

Contact: 612.604.6548, jflom@winthrop.com

The material contained in this communication is informational, general in nature and does not constitute legal advice. The material contained in this communication should not be relied upon or used without consulting a lawyer to consider your specific circumstances. This communication was published on the date specified and may not include any changes in the topics, laws, rules or regulations covered. Receipt of this communication does not establish an attorney-client relationship. In some jurisdictions, this communication may be considered attorney advertising.