For more than two years, the American economy has defied expectations, avoiding a widely-predicted recession.

Today, the risk of recession rises again, but both the economy and American retailers continue to show resilience. Several factors are playing to retailers’ advantage in 2025:

- Retailers are feeling positive. In Upside’s Q1 2025 pulse survey, 87% of fuel & c-store retailers reported their financial health as good or excellent.

- The labor market has shown real strength. Unemployment is relatively low at roughly 4%, and rising real wages (up 1.4%) are keeping spending afloat.

- The Federal Reserve is signaling two rate cuts in 2025. Reduced interest rates should provide another shot in the arm for consumer spending.

- OPEC+ is expanding production, and industry deregulation may increase domestic oil supply. Those actions could mitigate any price pressures caused by energy tariffs.

Retailers are adapting. And the ones that succeed are those who take proactive steps now to prepare for what’s ahead.

Retailers see hope, but pressure points remain

The need to adapt is strong, of course, because the headwinds facing retailers are formidable.

The Fed has kept interest rates elevated to start 2025, to manage stubborn inflation. Since the start of the year, tariffs — some implemented, some delayed, sometimes both, within 24 hours — have unsettled the market. Regardless of the direct impact of energy tariffs on fuel prices, general uncertainty can have indirect effects on the industry, too.

Fuel also faces its own specific challenges. Even as overall revenue appears stable, inflation-adjusted metrics paint a picture of declining demand. Daily fuel gallons sold per station have dropped 5.5% year-over-year. Inside the c-store, revenue per transaction dropped by 4.9% when adjusted for inflation. Geopolitical volatility could shock oil prices and shake up the equation even further.

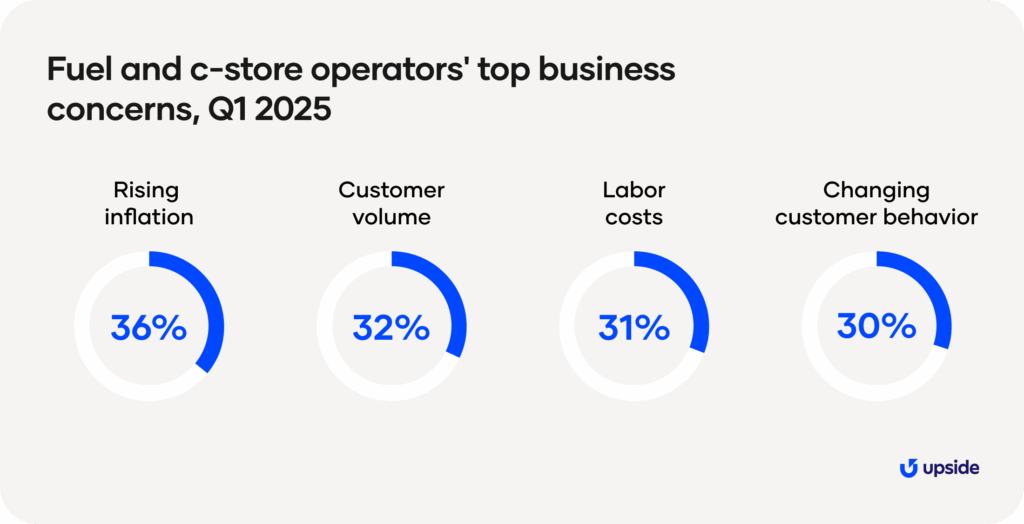

In that same retailer pulse survey as above, fuel and c-store operators expressed concerns about cost alongside their optimism for their business.

These concerns roughly mirror results from our earliest pulse survey in late 2023, when inflation and labor costs were once again two of the top three challenges.

Suffice it to say, it’s extremely hard to predict what tomorrow will look like for fuel retailers, let alone the rest of the year. Strong fundamentals are creating reasons for optimism, but retailers know they still need to navigate challenges carefully.

What should retailers do now?

Staying alert is only half the battle — the retailers that take proactive steps now will be best positioned to thrive. Here’s what we recommend:

1. Reach new customers before they decide where to stop

Loyalty programs are great for existing customers, but what about everyone else? Digital tactics like location-based promotions, mobile marketing, and marketplaces can build awareness and drive more visits from uncommitted customers.

2. Track inflation-adjusted revenue metrics

Don’t let topline revenue mislead you. Adjusting for inflation gives you a clearer picture of customer demand and performance over time.

3. Diversify your value propositions

Inside sales, food service, and customer loyalty matter more than ever. Delivering differentiated experiences that set your business apart from the competition and keep customers coming back for more can make all the difference.

By locking in on the right metrics, diversifying your value, and reaching customers earlier, retailers can stay ahead of shifting demand signals, finding stable growth amid uncertainty. Learn more about how Upside can help.

Upside tracks the state of retail fuel with data from 20,000+ stations and c-stores. Subscribe to benchmark your business in the industry and make data-driven decisions.