Cash flow is everything when you sell fuel, oil, or lubricants. With large invoices, tight margins, and fast-moving deliveries, waiting days—or weeks—to get paid creates friction you can’t afford.

The good news: online payments can help you accelerate receivables without adding costs or complexity.

Here are five simple steps to get started:

1. Understand Your Customer’s Needs

Not all fuel customers pay the same way. While recurring accounts may be fine with automatic bank drafts, spot buyers and one-off commercial customers often want more control. They don’t want to hand over bank access—they want to initiate payment when they’re ready.

Give them that option, and you remove friction from the payment process. More control for them means faster payments for you.

2. Evaluate Your Accounting Technology

Before introducing new payment options, make sure your systems can handle them. Are you emailing invoices with clickable links? Does your accounting software support payment tracking and reconciliation?

Manual processes slow down cash flow. Even if customers pay quickly, your internal delays in processing and posting payments can tie up cash unnecessarily.

3. Evaluate Your Current Payment Methods—and Calculate the Cost

Let’s be honest: checks and wire transfers are costing you time and money.

- Checks take days to arrive and process—and they often get lost or delayed.

- Wires require manual entry and coordination, often during banking hours.

- Credit cards offer speed, but the fees can eat into margins if not handled properly.

If you haven’t calculated the true cost (in both time and transaction fees) of your current payment methods, now is the time.

4. Consider Modern Online Payment Methods

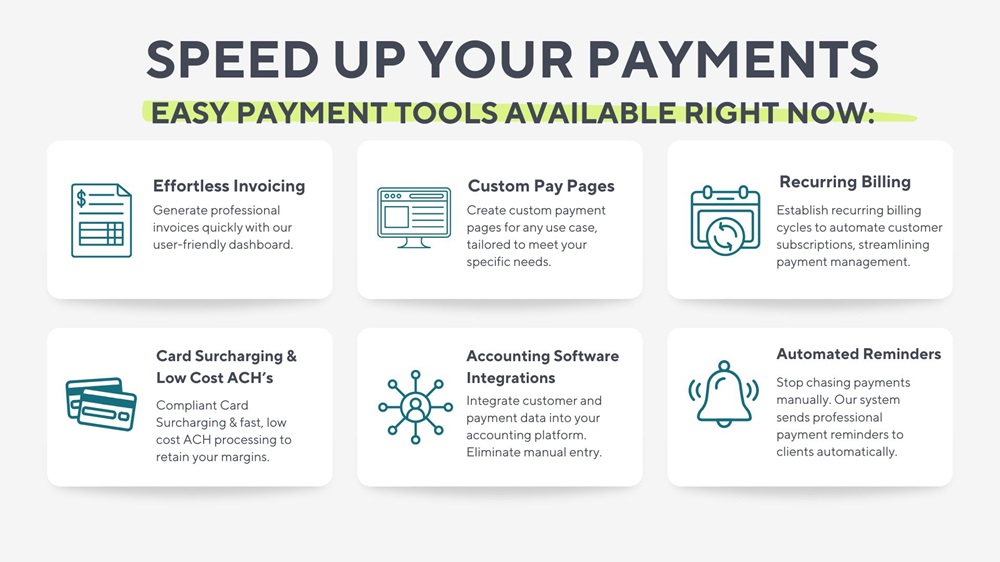

Today’s payment tools are faster, cheaper, and built to scale with your business.

- ACH (bank transfers) are ideal for large invoices: low fees, secure processing, and quick settlement.

- Surcharging allows you to legally pass credit card fees to the customer, protecting your margin.

- Online payment links in invoices let customers pay instantly—no more back-and-forth emails or bank login drama.

These tools don’t just speed up payment—they simplify your back office too.

5. Work With the Right Partner

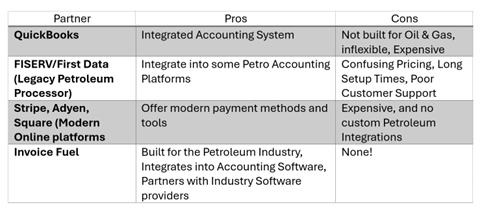

Not all payment platforms are created equal—and most weren’t built for fuel marketers.

That’s where Invoice Fuel comes in. Purpose-built for the oil and gas industry, Invoice Fuel makes it easy to accept ACH and card payments, auto-match them to invoices, and get set up in a single day. With built-in surcharging, strong security, and a workflow that fits the way you already operate, it’s a simple upgrade that delivers real results.

You move fuel fast. Your payments should keep up.

Get paid faster, with less hassle—start with Invoice Fuel at invoicefuel.com.

.