For many businesses, cash flow is a constant concern. The traditional invoicing process often involves a significant waiting period, manual data entry, and time-consuming follow-ups, all of which can strain your working capital and slow down growth. In today’s digital economy, an increasing number of companies are turning to a simple, effective solution to this problem: Pay Links.

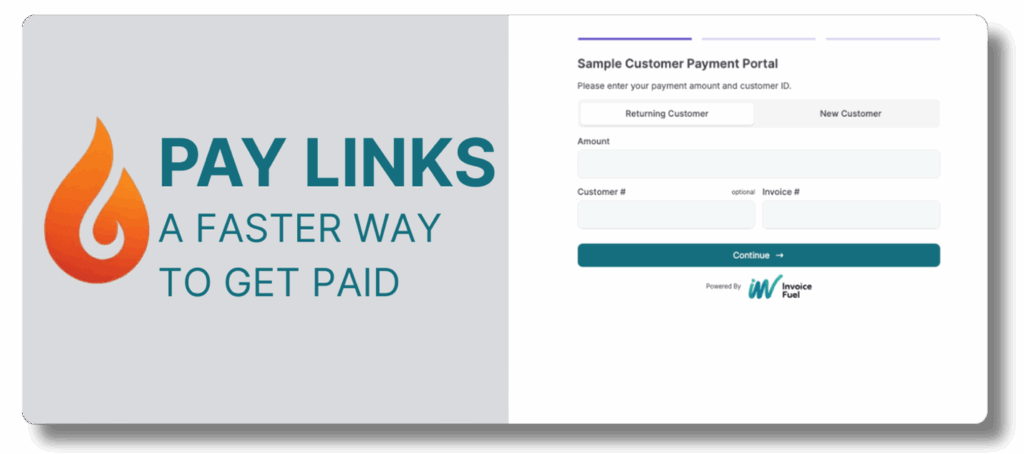

A Pay Link is a unique, secure URL you can instantly generate and share with clients. Instead of waiting for a check to be mailed, a client can simply click, pay, and you receive confirmation in real-time. This simple shift isn’t just a minor convenience; it’s a strategic move that addresses several key business challenges.

Secure New Customers in a Rush

In competitive markets like the oil and gas or service sectors, speed and efficiency are paramount. When a potential new customer needs a quick fuel delivery or urgent service, the ability to send a payment link on the spot can be the difference between winning their business and losing it. Instead of going through a lengthy account setup process, they can pay instantly, which reduces friction and enables you to secure a new client immediately. This not only improves the customer experience but also opens a new channel for spontaneous business acquisition.

Keep More of Your Money

The benefits of using Pay Links go far beyond just speed. For businesses operating on tight margins, every dollar counts. According to industry data, ACH fees can range from as little as $0.26 to over $15, depending on the provider and transaction size. When choosing a platform, look for one that caps these fees to protect your bottom line.

Additionally, to combat rising credit card processing costs (which can be over 3% per transaction), a growing number of businesses are implementing surcharging. While this practice is subject to state and card network rules, a payment platform with built-in surcharging capabilities can help you recover those fees and keep more of your revenue.

Sync with Your Petro Accounting Software

Manual data entry is a leading cause of accounting errors and consumes valuable administrative time. A recent study by Deloitte found that businesses that integrate their payment systems with their ERP software reported a 35% reduction in reconciliation times. The right Pay Link provider for the Oil & Gas industry should offer seamless integration with your existing petro accounting software (such as PDI, AIMS, iRely, and ADS). Automating this process reduces human error and frees up your staff to focus on business growth.

Choosing the Right Platform: The Difference is in the Details

With Pay Links gaining traction in the US, many major platforms have recently launched their own versions of this feature. Just recently (September 2025), PayPal launched its own Pay Links for its users. While this is a peer-to-peer function, many other platforms are business-focused.

Here are a few solutions that might interest you:

- Stripe’s links are highly customizable for developers and general e-commerce.

- Square’s links are built for simple, on-the-go transactions, often for retail.

- QuickBooks offers links as a convenient tool for businesses already using their accounting ecosystem.

- Some legacy providers like FISERV may offer links, but their setup can be cumbersome and require advanced technical skills.

These solutions serve a broad market but may take significant customization for the unique needs of a complex industry, particularly those requiring Petro Accounting integrations. When evaluating your options, look for a partner who can accommodate your specific workflow.

To see how easy Pay Links can be to implement, we invite you to watch a one-minute demo of creating and sharing a Pay Link: See Demo Here

If you want to find out more about Pay Links, contact KC (see below for contact details).