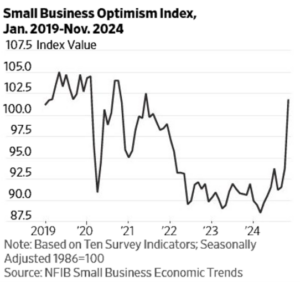

The November election in which Republicans took control of not only the White House, but of both the House and the Senate, has been met with a surge in stock in prices and in business optimism (see chart). In this update, we explore what the election means for U.S. energy policy.

Donald Trump makes no qualms about his support for fossil fuels, as his well-known quote “Drill baby, drill” suggests. Scott Bessent, nominee for Treasury Secretary has a simple 3-3-3 formula: he wants to increase economic growth to 3%, cut the deficit to 3% of GDP, and raise oil and gas output 3% by 2028. The plan to raise oil and gas output is meant to lower regulatory hurdles and to open more federal land and blocks to offshore drilling. Regulatory relief can come from expedited permitting of energy projects, including liquified natural gas projects and pipelines. Trump wants to create a National Energy Council to cut red tape, thereby increasing production and giving the U.S energy dominance.

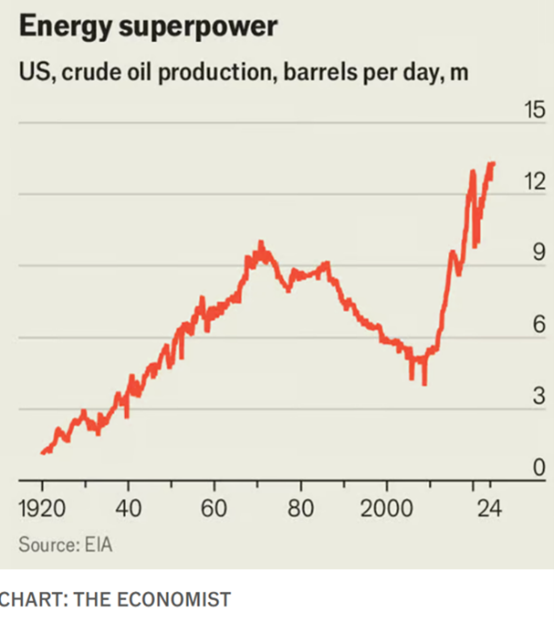

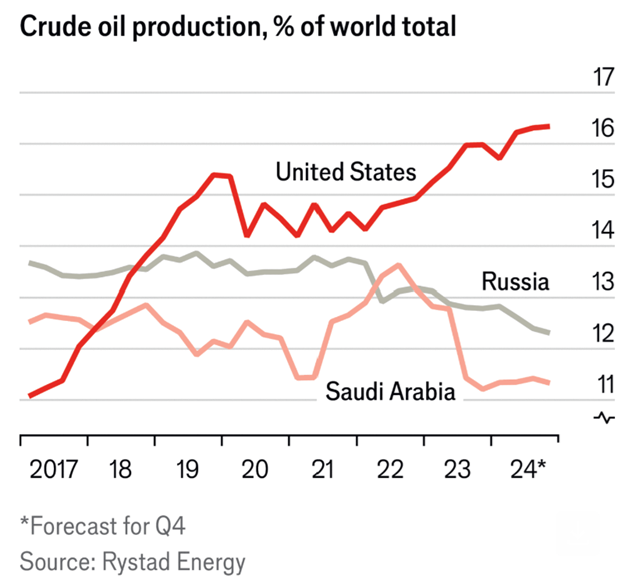

These incentives to increase production can help the U.S. increase supply if producers respond. Unlike the petrostates, U.S. energy production is determined by private firms. These firms must calculate whether the return on capital justifies the risk of making new investment. Thanks to technological change and market forces, U.S. energy production has soared to record levels. The U.S. is now the world’s largest producer of crude oil, surpassing Russia and Saudi Arabia by a wide margin (see charts). Production in October 2024 was 13.4m b/d, up from 11.5 m b/d when the war in Ukraine started.

The big increase in production over the last four years has been under a Democratic administration in the White House and the Senate. Despite their “Green Agenda,” market forces have done their job. These same forces may also make it difficult for the incoming administration to achieve a 3% increase in output by 2028. According to a survey by the Kansas City Federal Reserve Bank, shale producers have little incentive to drill more unless oil prices reach $89 a barrel, which is significantly higher than recent oil prices (around $70 per barrel). The global oil supply is plentiful and global economic growth lackluster. The Energy Information Administration expects oil production to rise by only .6m b/d by 2028 and in December, Chevron slashed its capital-expenditure forecast for 2025.

The renewed emphasis on fossil fuels does not mean climate efforts and the move to clean energy are dead. Instead, the Trump administration wants abundant energy from a variety of sources without pitting one source against another. After all, it takes a lot of fossil fuels to mine minerals, produce alternative energy capital goods (e.g., windmills, solar panels and EVs), and transport them to market. Even Elon Musk, the world’s richest man and the developer of the Tesla, says we need more oil and gas. What we are seeing is that the cost of renewables has plunged as technology continues to advance. If we can realize, in mass production, a solid-state battery that is safer and can be recharged quickly with extended range, it will be a game changer for EV adoption among passenger vehicles. Electric energy production and distribution will need to ramp up substantially for this to become a reality, and it will likely take many years to do so.