You’ve seen the rise of credit card processing fees eating into profit margins. You’ve also seen how businesses try to fight back: a 3% surcharge here, a $5 convenience fee there. (And don’t even get me started on tipping at fast food restaurants! Do I really need to tip 15% for someone to “toasting” my sandwich in the microwave? We’ll tackle that another time).

Today, let’s explore the alluring world of “Zero Fee Processing” and how it might benefit or hurt your business.

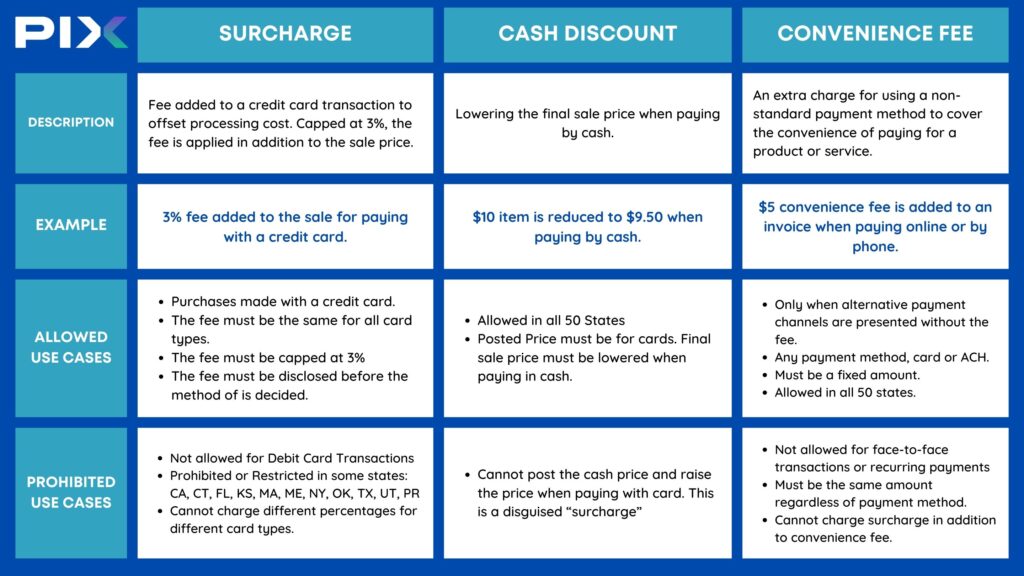

The card brands recognize three main ways to reduce processing fees: surcharging, convenience fees, and cash discounting. (There’s also the “service fee,” but that only applies to government and educational institutions).

SURCHARGING

Imagine this: Your car is being serviced, and technician hands you an invoice stating a 3% surcharge will be added for paying with a credit card. That’s surcharging in action.

Definition: A surcharge is a fee added to a credit card transaction to offset processing costs. It’s usually a percentage of the transaction, typically capped at 3%, depending on state regulations and card network rules.

Rules:

- Legality: Surcharging is allowed in most states, but it’s prohibited in Connecticut, Maine, and Massachusetts. It’s also restricted in California, Florida, Kansas, New York, Oklahoma, Texas, Utah, and Puerto Rico, with varying limitations on the amount or specific disclosure requirements.

- Disclosure: Merchants must disclose the surcharge at the point of sale, on receipts, and on any online platforms.

- Card Network Rules: Visa, Mastercard, American Express, and Discover have specific rules regarding surcharging, including notification requirements and limitations on the amount. For example, Visa recently lowered its maximum surcharge to 3.00% (from 4%), and each card brand has rules about different surcharge amounts for different card types.

- No Surcharging on Debit Cards: Surcharges cannot be applied to debit card transactions.

PIX’s Take:

Surcharging has become a popular way for payment processors to advertise “Zero Fee Processing!” But here’s the catch: many processors don’t follow the strict regulations around surcharging. We often see retailers charging above the allowed maximums, sometimes even exceeding 4%. Processors are responsible for ensuring their merchants comply with surcharging regulations, and non-compliance can result in fines or even termination of merchant accounts.

CASH DISCOUNTING

Cash discounting is a clever way to incentivize cash payments without explicitly penalizing credit card users. Essentially, you build the credit card processing fee into your prices and offer a discount to customers who pay with cash.

Rules:

- Legality: Good news! Cash discounting is legal in all 50 states.

- Disclosure: Clearly display both the discounted cash price and the regular price for credit card payments.

- No Misrepresentation: Don’t try to disguise a surcharge as a cash discount.

CONVENIENCE FEES

Unlike surcharges, which are tied to credit card usage, convenience fees are charged for the convenience of using a specific payment method or channel. Think of paying extra for expedited shipping or choosing to pay over the phone instead of in person.

Rules:

- Clarity: The fee must be clearly disclosed before the transaction.

- Justification: The fee should genuinely reflect the added costs of that specific payment method.

- No Duplication: You can’t charge a convenience fee and a surcharge on the same transaction.

Which Strategy is Right for You?

Choosing the right “zero fee” strategy depends on your business, your customers, and your comfort level with regulations.

- Surcharging: Best for businesses with high credit card volume and high average transaction values. However, be prepared for potential customer pushback and the complexity of compliance.

- Cash Discounting: Great for small businesses with a lot of cash transactions. It’s generally viewed more favorably by customers than surcharging.

- Convenience Fees: Ideal for online businesses, recurring billing, or situations where alternative payment methods incur extra costs.

While “zero fee processing” sounds enticing, it’s not a magic bullet. Each method has its own set of rules, limitations, and potential drawbacks. By understanding these nuances and choosing the right strategy for your business, you can effectively reduce processing costs without alienating your customers.

Want help with reducing your processing fees? We’re here to help!