End-of-Year Performance Summary by SG Vertical

Study Groups (SG) member performance in 2025 reflected steadiness in a year of uneven economic conditions. “Flat was the new up” in most of the industries our members participate in. Tariffs, cost pressures, and investment uncertainty weighed on several sectors, making the year more challenging than in most years in our post-Covid recovery.

Yet, SG members generally performed ahead of, or in line with, their respective industries. They demonstrated resilience, discipline, and thoughtful execution.

We are grateful for the ideas shared within our groups. Our members helped each other successfully navigate what otherwise would have been more challenging conditions. The value of peer sharing was proven once again, setting a solid foundation for the year ahead.

Here’s a quick summary of the respective SG verticals.

General Contractors

Stable Performance in a Challenging Market

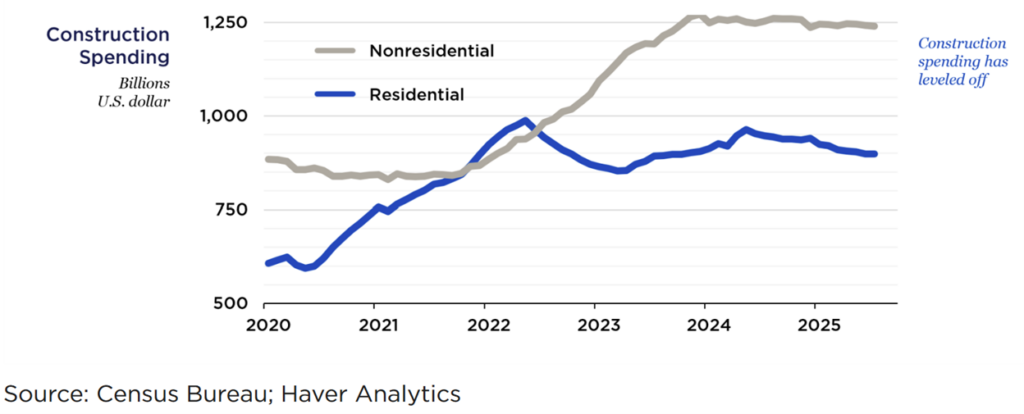

General Contractor SG members delivered even results in 2025 amid a more difficult construction environment. Twenty-one General Contractor members producing $2.1 billion total in annual revenue experienced flat revenue closely tracking national industry trends.

Tariffs and elevated construction costs contributed to uncertainty and delayed investment decisions. Strength in healthcare, technology (notably data centers), and education construction helped offset softness in manufacturing and general commercial markets. Overall, SG construction members navigated a flat market effectively, preserving scale and positioning for recovery as conditions improve.

Ready Mix Concrete

Outperformance Driven by Volume and Pricing Discipline

Ready Mix Concrete SG members significantly outperformed the broader industry in 2025. The typical SG member grew revenue 7.4 percent year-over-year while increasing cubic yards sold by 2.1 percent.

By comparison, IBISWorld projects industry revenue growth of only 1.9 percent, largely driven by price increases, with volumes expected to decline 3 to 4 percent or more. Despite higher cement costs from tariffs and softer overall construction demand, SG members gained share and expanded volumes, highlighting strong market positioning and operational execution.

Convenience Stores

Strong Results Sustained at Historically High Levels

Convenience Store SG members delivered solid, stable performance in 2025. A group of 87 operators managing nearly 6,000 stores experienced a modest 2.2 percent decline in profitability, primarily driven by rising operating expenses.

Fuel margins remained flat year-over-year, while merchandise and foodservice gross profit dollars each grew 2.3 percent. Although expense growth of 1.9 percent tempered bottom-line results, overall performance remained strong by historical standards, reflecting focused operations and resilient consumer demand.

Convenience Distribution

Expanded Market Share

Convenience Distribution SG members experienced solid year-over-year revenue gains of 5 percent. National convenience-store operator Inside Sales (foodservice + merchandise) revenue growth was only 1 to 2 percent over that period. Accordingly, our Convenience Distribution SG members captured greater market share.

Lubricants Distribution

Continued Share Gains in a Contracting Market

Lubricants SG members once again outperformed industry benchmarks in 2025. Forty-eight members selling nearly 350 million gallons in total increased volumes by 4.3 percent year-over-year.

This growth stands in contrast to national lubricants volumes, which declined by more than 2 percent according to the Energy Information Administration (EIA). While lubricant margins plateaued after several years of expansion, SG members’ volume gains underscore their competitive positioning, acquisition strategies, and customer retention in a challenging market.

Petroleum Marketing

Profitable Growth Despite Margin Pressure

Petroleum Marketing SG members also exceeded industry performance in 2025. One hundred seventy-one members selling just shy of 21 billion gallons annually increased total gallons by 5.5 percent—well above the EIA’s estimated 1.5 percent national growth rate.

Importantly, members achieved this growth profitably, sustaining an average 15 percent return on capital employed despite flat product margins. This reflects disciplined capital management, operational excellence, and effective market expansion strategies.

Overall Takeaway

Across SG industries, 2025 tested member-firm resilience in a way not seen in recent years. While not every sector delivered growth, SG members consistently matched or exceeded industry performance, protected profitability, and strengthened their competitive positions. The value of peer sharing was proven once again, setting a solid foundation for the year ahead.