Oil and gas Marketers and Retailers are certain of three things: Death (by regulation), Taxes, and Interchange Rates. While these are certain, the state of Illinois has had enough.

“NO MORE INTERCHANGE FEES ON TAXES!” – Illinois Interchange Fee Prohibition Act (IFPA)

On June 7, Illinois signed into law the Interchange Fee Prohibition Act (IFPA), banning banks and payment networks from charging interchange fees on card transaction taxes and tips. A big win for Gas Stations, right? I’d love to think so, but this sounds like a technical and compliance nightmare.

Let’s see how this law could impact our industry if many states follow suit. Here are some fast facts (seasoned with our hot takes):

- Payment processors must be compliant by July 1, 2025. Though it only impacts Illinois, this will require coordination of our major processors.

- PIX’s take: Do you remember the EMV rollout? Of course you remember it, and the pain it brought. With a decade’s notice, the deadline had to be pushed back years (especially with pay-at-the-pump compliance). Millions of dollars were spent on EMV readers, software & hardware upgrades, and non-compliance fees. This change will be of the same magnitude.

- Every one of our industry processors (Heartland, FISERV, etc.) and point-of-sale companies (Verifone, Gilbarco Passport, NCR) will have to write new software.

- Bad News: Expect processors and POS companies to invent new fees to cover the costs.

- Good News: once it’s done, every other state will have an easier implementation road.

- Banking Associations and Credit Unions hate this law and are vocal about it. Expect many cases delaying or repealing it to emerge.

- Of course they hate it. Card-issuing banks take home the lion’s share of interchange fees, which will eat into their revenues and stock prices. Expect Visa to invent new acronyms to recoup their losses (see the trend yet?

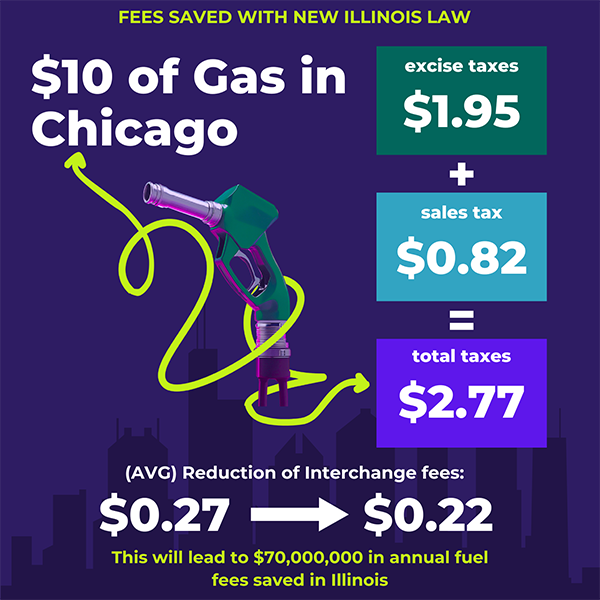

- Gas Stations would be the largest beneficiary of this law. Excise and Sales taxes are included in the prohibition, eating a huge chunk of the price per gallon. (see chart).

- Overcoming the obstacles listed above, this change would be massive for gas stations. (Jobbers, you might end up with some tax reporting hellscape. Sorry – I’m just the messenger.)

We’ll see how this plays out. I’d love to see major reform in interchange fees and their impact on retailers. Though this would be hard to implement, it’s worth the engineering challenge. (After all, SpaceX just caught a 400-foot-tall booster with chopsticks.)

If you’re curious about how interchange fees impact your business, PIX can help! Email me at kc@pixpayments.com and we’ll analyze your processing fees for FREE.